Land Loan Calculator – Simple & Accurate Results

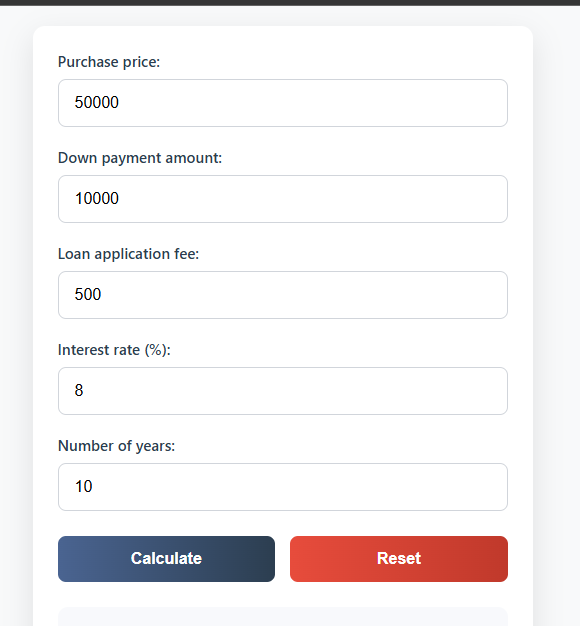

Our Land Loan Calculator is designed to help you quickly calculate monthly payments, interest, and financing costs for purchasing land. By entering details like Purchase Price, Down Payment Amount, Loan Application Fee, Interest Rate (%), and Number of Years, you can instantly get accurate loan results.

Whether you’re buying land for building a home, investment, or farming, knowing your loan terms is crucial. This land payment calculator gives you a clear picture of what you’ll pay monthly and over the loan period.

Land Loan Calculator

Image Example:

How to Calculate a Land Loan Payment

Calculating your land loan payment is straightforward with our online tool. First, convert the annual interest rate to a monthly rate (divide by 12)investopedia.com. For example, a 6% annual rate becomes 0.5% per month. The calculator then applies this monthly rate, along with the loan amount (purchase price minus down payment) and the number of payments, to compute the monthly payment. Here’s how to use our land loan calculator step by step:

Loan Amount: Enter the land purchase price.

Interest Rate: Input the annual interest percentage.

Down Payment: Enter a dollar amount or a percentage of the pricetexasfarmcredit.com.

Term: Choose the loan duration in years.

Calculate: Click to get the monthly payment, total interest, and full amortization scheduletexasfarmcredit.com.

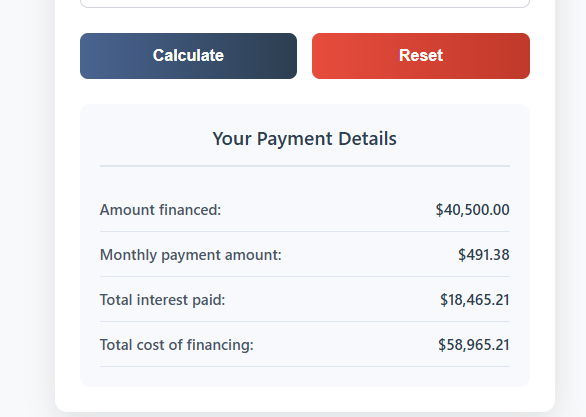

This shows exactly “how to calculate interest for a land loan” in practice. After clicking calculate, the tool displays how much of each payment goes toward interest versus principal. It outputs both the monthly payment and the total amount you’ll pay over the life of the loantexasfarmcredit.com. You can experiment with different rates, down payments, and terms to see how the payment changes without doing the math manually.

Land Loan Calculator with Down Payment and Fees

A key feature of our calculator is handling down payments and fees effectively. Land loans often require significant equity: FDIC rules set 35% down for raw land and 15% for improved landcanopycu.comcanopycu.com. Our land loan calculator with down payment lets you enter the down payment (in dollars or percent)texasfarmcredit.com and immediately recalculates the loan balance. It then computes your monthly payment based on the remaining principal. You can also include any loan application fees or monthly costs. By adjusting these fields, you see how a larger down payment lowers your monthly bill and total interest. Entering fees up front ensures your estimate matches real costs and helps avoid surprises later.

Land Loans Calculator: Budget Your Payments

Our land loans calculator is a versatile planning tool that helps you budget effectively. Once you enter your values, you can view or save the full amortization schedule to track payments over time. This calculator is part of a suite of related tools on our site. For example, if you plan to build on the land, use our Construction Loan Calculator. To estimate insurance needs during construction, try the Builders Risk Insurance Calculator. For land preparation costs, use our Land Clearing Cost Calculator. If deciding whether to rent or sell, check the Rent vs Sell Calculator. For seller-financing scenarios, see the Land Contract Calculator and Land Contract Amortization Calculator. Each tool provides clear inputs and instant results so you can plan every aspect of your land purchase and development with confidence.

Sources: Land loan formulas and amortization detailsinvestopedia.comtexasfarmcredit.com; down payment and loan-type guidancecanopycu.comcanopycu.com; usage examples from financial calculatorstexasfarmcredit.comtexasfarmcredit.com.

How can a Land Loan Calculator help me budget and plan my land purchase?

A land loan calculator is an essential tool for budgeting and planning your land purchase because it provides a clear picture of your financial obligations before you commit to a loan. By entering key details such as the purchase price, down payment amount, loan application fees, interest rate (%), and loan term, the calculator instantly estimates your monthly payments, total interest, and overall cost of financing. This allows you to experiment with different scenarios, such as increasing your down payment to reduce monthly payments or comparing loan terms to see how interest accrues over time. With this information, you can make informed decisions about how much land you can afford, how to structure your payments, and how to plan for additional costs like taxes or closing fees. Ultimately, using a land loan calculator helps you avoid surprises, stay within your budget, and confidently plan your land investment for both short-term affordability and long-term financial stability.

❓ Frequently Asked Questions (FAQ) – Land Loan Calculator

1. What is a Land Loan Calculator?

A land loan calculator is an online tool that helps you estimate your monthly payments, total interest, and overall cost when financing a piece of land. By entering details like purchase price, down payment amount, loan application fee, interest rate (%), and number of years, the calculator shows a clear breakdown of costs. This makes it easier for buyers to budget and plan before applying for a land loan.

2. How do I use the Land Loan Calculator?

Using the land loan calculator is simple:

Enter the purchase price of the land.

Add your down payment amount.

Input any loan application fee if required.

Provide the interest rate (%) offered by your lender.

Select the number of years you plan to repay the loan.

Click “Calculate” and the tool will display your monthly payment, total interest paid, and total cost of financing.

3. Why should I use a Land Loan Calculator before applying?

The land loan calculator helps you avoid surprises by showing you the real cost of borrowing. It allows you to compare different scenarios, such as varying interest rates or down payment amounts. This way, you can decide whether you can afford the loan or if you need to negotiate better terms. It’s a valuable step before committing to a financial agreement.

4. Can the Land Loan Calculator show interest separately?

Yes. Our land loan calculator with down payment also calculates interest separately. After entering your details, it shows:

Amount Financed (loan amount after down payment)

Monthly Payment Amount

Total Interest Paid

Total Cost of Financing

This feature makes it easy to understand exactly how much you’re paying in interest versus principal.

5. How accurate is the Land Loan Calculator?

The land payment calculator provides a reliable estimate based on the values you enter. However, keep in mind that lenders may have additional charges, taxes, or conditions not included in the calculator. For the most accurate results, use this tool as a guide and confirm details with your lender.

6. What’s the difference between a land loan and a home loan?

Unlike a home loan, a land loan is specifically for purchasing raw land or plots. Interest rates can be slightly higher, and lenders may require larger down payments. That’s why using a land loan calculator is important—to see how these differences affect your payments compared to standard home loans.

7. Can I calculate balloon payments with this Land Loan Calculator?

Currently, this land loan calculator is designed for standard fixed-rate loans. If your lender offers a balloon payment option, you can still use the calculator for the base monthly payments, but you’ll need to manually add the final balloon payment.

👉 Pro Tip: For more financial tools, explore our Land Contract Calculator, Land Contract Amortization Calculator and Land Clearing Cost Calculator