Balloon Loan Calculator – Free & Accurate Tool

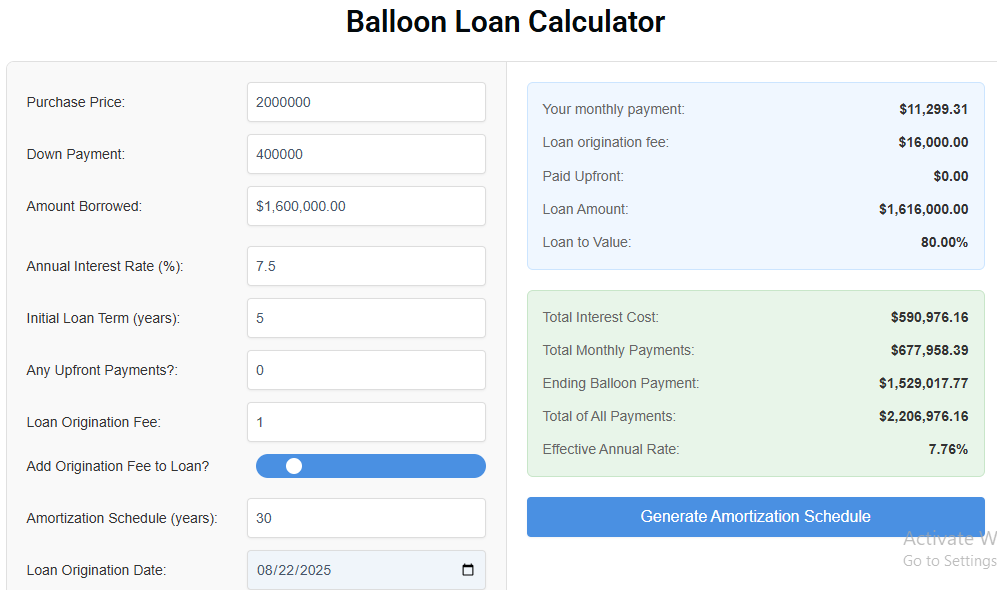

Balloon Loan Calculator is a simple yet powerful way to figure out your monthly loan payments, interest, and the final balloon balance. Unlike a traditional loan, a balloon loan requires smaller payments during the term but leaves a large final payment (the balloon) due at maturity. This tool is designed to make financial planning easier by showing you exactly what to expect.

If you’re looking for a balloon loan payment calculator, this tool provides detailed results instantly. You can enter your purchase price, down payment, interest rate, and balloon term to generate a clear amortization schedule. This not only helps in budgeting but also gives you confidence when discussing financing options with lenders.

👉 Try our other tools like the Land Contract Calculator for more real estate loan insights.

👉 Learn more about balloon loans from Investopedia

Balloon Loan Calculator

How the Balloon Loan Calculator Works

The Balloon Loan Calculator works by applying standard loan amortization formulas while factoring in the balloon payment. Unlike traditional loans that spread the repayment evenly, balloon loans keep monthly installments smaller and defer a significant portion of the principal to the end.

Our loan calculator with balloon gives you both the monthly payment breakdown and the final lump-sum balloon amount. By entering details like the loan term, interest rate, and balloon percentage, you’ll see how much you’ll need to prepare for the last payment.

This helps borrowers compare whether a balloon loan is the right option for their financial situation. For example, investors often choose balloon loans because of the flexibility they provide in the early stages of ownership. However, understanding the balloon loan amortization schedule is crucial before signing an agreement.

👉 Want to explore repayment strategies? Visit our guide on How to Calculate Interest on a Land Contract

Benefits of Using a Balloon Loan Payment Calculator

One of the biggest advantages of using a balloon loan payment calculator is clarity. Instead of relying on estimations, you’ll get accurate numbers that show both monthly obligations and the balloon payment.

This tool can help you:

Compare balloon loans with standard amortized loans.

Plan for large future payments without financial surprises.

Understand how different terms and interest rates impact your loan.

Our calculator also makes it easy to adjust numbers instantly. Whether you’re a first-time homebuyer or a real estate investor, the balloon loan amortization schedule ensures you’re fully aware of your financial commitment.

👉 For more smart calculations, check our Contract for Deed Calculator with Balloon Payment.

👉 See expert advice on balloon loans at CFPB.

Balloon Loan Amortization Explained

The term balloon loan amortization refers to how payments are spread out over the loan term. In most balloon loans, payments only cover a small part of the principal plus interest, leaving a significant balance due at the end.

Our loan calculator with balloon reveals the complete amortization schedule so you can visualize how much principal remains unpaid until the balloon date. This transparency helps you plan ahead, refinance if necessary, or decide whether the loan structure fits your budget.

Remember, while balloon loans can offer short-term relief, they require careful long-term planning. Using the Balloon Loan Calculator ensures you don’t overlook the financial impact of the final balloon payment.

👉 Related resource: What is a Land Contract?

Image Example

❓ Frequently Asked Questions (FAQ) – Balloon Loan Calculator

Q1: What is a Balloon Loan Calculator?

A Balloon Loan Calculator is a financial tool that helps borrowers estimate their monthly payments, interest, and the final balloon payment due at the end of the loan term. Unlike a standard loan, balloon loans require smaller regular payments but leave a large lump-sum amount at maturity.

Q2: How does a Balloon Loan Payment Calculator work?

A balloon loan payment calculator works by applying an amortization formula. You enter details like purchase price, down payment, loan term, and interest rate. The calculator then shows your monthly payment schedule along with the final balloon balance, helping you prepare for future obligations.

Q3: What is Balloon Loan Amortization?

Balloon loan amortization is the process of spreading out loan payments over time while keeping a large balance due at the end of the term. During the loan period, payments usually cover only part of the principal and interest. Our loan calculator with balloon displays the full amortization schedule so you can see exactly how much you’ll owe when the balloon payment is due.

Q4: Who should use a Balloon Loan Calculator?

Anyone considering a balloon loan should use this calculator before signing an agreement. It’s especially helpful for:

Homebuyers who want lower monthly payments at first.

Real estate investors looking for short-term financing.

Borrowers planning to refinance before the balloon payment is due.

Q5: Is a Balloon Loan Calculator different from a Regular Loan Calculator?

Yes. A regular loan calculator spreads payments evenly across the entire term. A loan calculator with balloon shows smaller monthly payments but highlights the large final balloon payment at maturity, giving you a clearer picture of the long-term financial commitment.