Cost of Equity Calculator: Accurately Calculate Your Equity Cost

Cost of Equity Calculator makes determining the cost of equity fast, accurate, and simple. Investors, business owners, and finance professionals use this tool for precise cost of equity calculation without manual errors. Whether you are learning how to calculate cost of equity using CAPM, Dividend Discount Model, or other methods, this calculator simplifies every step. For a more detailed guide on formulas, methods, and tips, check out our related blog: Cost of Equity Calculator: Your Ultimate Guide to Correctly Calculating Equity Costs. Understanding how do you calculate cost of equity ensures better financial decisions and planning.

Cost of Equity Calculator

Calculate using the Capital Asset Pricing Model (CAPM)

Cost of Equity

About CAPM

The Capital Asset Pricing Model (CAPM) describes the relationship between systematic risk and expected return for assets, particularly stocks. It is widely used throughout finance for pricing risky securities and generating expected returns for assets given the risk of those assets and cost of capital.

What is Cost of Equity Calculator?

Cost of Equity Calculator is the easiest way to determine the cost of equity for your business or investment portfolio. Investors and finance professionals use this calculator to simplify complex calculations and make informed decisions. With this tool, you can calculate cost of equity using various methods such as the Capital Asset Pricing Model (CAPM) and Dividend Discount Model (DDM).

By using our cost of equity calculator, you save time and reduce errors compared to manual calculations. Accurate cost of equity calculation is essential for financial planning, budgeting, and evaluating investment opportunities. Understanding how to calculate cost of equity helps business owners estimate their required return and make strategic funding choices.

This calculator also allows for comparisons across multiple scenarios, ensuring your financial strategy aligns with market expectations. For more detailed guidance on equity finance, you can refer to Investopedia’s guide on cost of equity

How to Calculate Cost of Equity

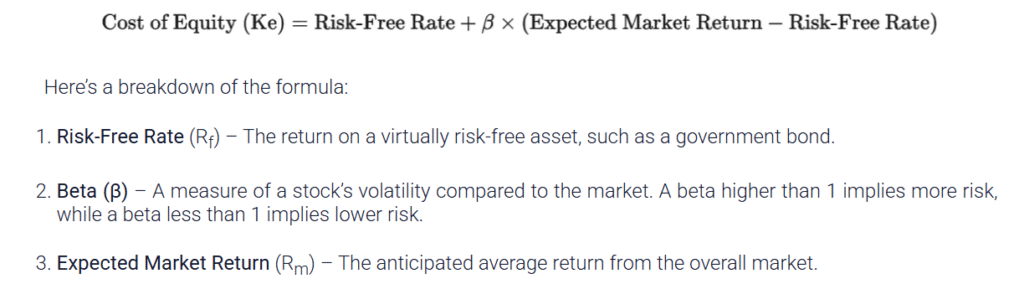

Calculating the cost of equity can seem complicated, but our cost of equity calculator makes it simple. Investors often use CAPM (Capital Asset Pricing Model), which considers the risk-free rate, beta, and expected market return. The basic formula for calculating cost of equity using CAPM is:

Cost of Equity = Risk-Free Rate + Beta × (Market Return − Risk-Free Rate)

Alternatively, the Dividend Discount Model (DDM) can calculate cost of equity by considering expected dividends and stock price growth. This method is useful for companies that regularly distribute dividends.

Knowing how to calculate cost of equity is critical for business owners when evaluating financing options or assessing investment risks. With the cost of equity calculator, you can quickly determine accurate figures without needing advanced financial knowledge. Learn more about CAPM here

Common Methods for Cost of Equity Calculation

There are multiple ways of calculating cost of equity, and choosing the right method depends on your financial context. The three most common approaches are:

Capital Asset Pricing Model (CAPM) – measures equity risk based on market volatility.

Dividend Discount Model (DDM) – calculates cost of equity from expected dividends.

Bond Yield Plus Risk Premium – adds a risk premium to the company’s bond yield for estimating equity cost.

Our cost of equity calculator allows users to try all these methods and compare results. Accurate cost of equity calculation is essential for capital budgeting, determining weighted average cost of capital (WACC), and strategic investment decisions.

For more insights, visit Corporate Finance Institute on cost of equity. Additionally, check our internal resource, Land Contract Calculator, for related financial tools.

Benefits of Using a Cost of Equity Calculator

Using a cost of equity calculator offers several advantages:

Time-saving: Quickly perform calculations without errors.

Accuracy: Ensures correct results for CAPM, DDM, and other methods.

Decision-making: Helps investors and business owners make informed financial choices.

Scenario Analysis: Compare multiple scenarios to assess potential returns.

Understanding how do you calculate cost of equity is crucial for financial planning. By regularly using a cost of equity calculator, you can confidently evaluate investment options and make strategic funding decisions.

Check external reference for practical application: Harvard Business Review – Cost of Equity. For more internal tools, explore our Financial Calculators Hub.

FAQ Section for “Cost of Equity Calculator”

1. A calculator of equity costs is what?

An estimate of the return investors demand for buying into a corporation is provided by a cost of equity calculator. It shows the least rate of return needed to offset the risk of owning equity.

2. What makes the cost of equity so significant?

The financial risk of investing in a firm is evaluated using the cost of equity. For investors, analysts, and corporate owners considering funding or valuation judgments, it is quite important.

3. Which algorithm is used by this calculator?

The Capital Asset Pricing Model (CAPM) forms the basis of our cost of equity calculator:

Equity Cost = Beta (Market Return – Risk-Free Rate) plus Risk-Free Rate

4. What inputs are required by the equity cost calculator?

You require the following:

Risk-Free Rate (Rf)

Market Return (Rm)

Beta values for the stock

5. May I apply this calculator to every kind of company?

Certainly. As long as you have the required inputs, this tool is appropriate for public or private businesses, new ventures, and already running companies.

6. Does the CAPM approach work for every case?

Though CAPM is much used, it presumes efficient markets. It functions best when market data on Beta and return projections are reasonable and accessible.